Short Video Payment and Monetization Platform

With the surge in demand for recharges, tipping, and membership subscriptions in the short video industry, Gallop World IT focuses on this scenario by creating solutions that include Mobile Payment Gateways and Recurring Billing Software. As one of the best subscription billing platforms, its system supports multi-channel payments, enabling full-process automation for recharges and deductions, and has already served dozens of short video enterprises. The accompanying Refund Management System helps reduce transaction disputes, leveraging professional expertise to assist platforms in achieving standardized and efficient transactions.

- Information

With the explosive growth of the short video industry, transaction scenarios such as user recharge tipping and membership subscriptions have become increasingly frequent, making secure and efficient online recharge and deduction systems a core pillar for platform operations. Gallop World IT, deeply rooted in the field of digital transaction system development and focusing on the needs of the short video industry, has built a comprehensive solution encompassing core components like the mobile payment gateway and recurring billing software. We not only provide platforms with stable mobile payment gateway integration services but also meet automatic deduction needs for scenarios like membership subscriptions through customized recurring billing software, while seamlessly connecting recharge processes via the in-app billing API, becoming a trusted technical partner for numerous short video platforms. To date, we have built transaction systems for dozens of short video enterprises. Our supporting refund management system and best subscription billing platforms services have effectively reduced transaction disputes and enhanced the user payment experience.

Gallop World IT always adheres to the philosophy of "transaction security as the foundation, user experience as the core," striving for excellence in the development of online recharge and deduction systems for short videos. Our mobile payment gateway supports integration with multiple channels such as WeChat Pay, Alipay, and UnionPay, ensuring the security of every transaction through encrypted transmission and risk control modules. The recurring billing software can set flexible billing cycles based on platform needs, working in tandem with the in-app billing API to automate the entire process of recharge, deduction, and renewal. As a recognized provider of best subscription billing platforms in the industry, we understand the importance of the refund process. Our independently developed refund management system enables rapid review of refund applications and precise calculation of refund amounts, while synchronously updating transaction data to avoid financial chaos. From optimizing the stability of the mobile payment gateway to adapting the recurring billing software to various scenarios, Gallop World IT leverages professional expertise to help short video platforms standardize and streamline their transaction operations.

Frequently Asked Questions

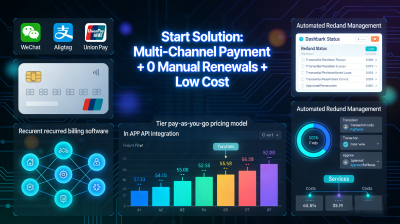

Q: We are a newly launched short video platform focused on talent live streaming. Our current recharge system has limited payment channels, membership subscriptions rely on manual renewal reminders, and the refund process is chaotic. We want to build a professional system but are concerned about high costs. How can we create a cost-effective transaction solution?

A: To address the needs of your platform at its early stage, we will provide a cost-effective solution based on "modular combinations + pay-as-you-go," centered around building foundational transaction capabilities with the mobile payment gateway, recurring billing software, and refund management system. First, integrate our mature mobile payment gateway to quickly enable multi-channel payment functionality without the need for in-house development, reducing initial investment. Simultaneously, deploy a lightweight recurring billing software that seamlessly connects with your platform's app via the in-app billing API, enabling automatic deductions for membership subscriptions and renewal reminders, completely replacing manual processes. The refund management system will establish a standardized refund process, supporting user-initiated applications and automated system reviews. For scenarios involving host revenue sharing, it can also synchronize deduction calculations to avoid financial disputes. As a provider of best subscription billing platforms, we will adjust service fees based on your platform's user volume tiers. Initially, you will only need to pay for core functionalities, and you can gradually upgrade features as your business grows, perfectly aligning with the development pace of a startup platform.

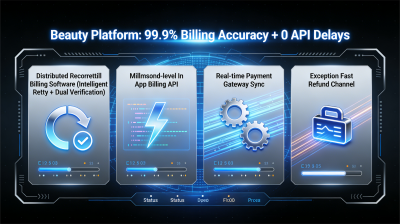

Q: We are a short video platform focused on the beauty niche, offering a "Monthly Beauty Tutorial" paid subscription service. However, our current recurring billing software often experiences missed or incorrect deductions, and the in-app billing API suffers from response delays, resulting in high user complaint rates. How can we resolve these issues thoroughly?

A: Resolving billing accuracy and API response issues lies in upgrading the system's core components and risk control capabilities, which is precisely where our strength as a best subscription billing platforms provider comes into play. We will replace your current system with a new recurring billing software designed with a distributed architecture and paired with an intelligent retry mechanism to avoid missed deductions caused by network fluctuations. Additionally, a dual verification algorithm will ensure the accuracy of deduction amounts and cycles. To address in-app billing API delay issues, we will optimize interface call logic and deploy nearby server nodes to control response times to the millisecond level, ensuring a smooth recharge and deduction process. The system will also operate in real-time with the mobile payment gateway, enabling instant synchronization of payment status for every transaction to reduce user anxiety. The accompanying refund management system will add a "fast refund for billing exceptions" channel. If incorrect deductions occur, users can quickly file an appeal, and the system will automatically verify and process the refund, reducing complaint rates. Through this solution, billing issues will be resolved at their root, rebuilding user trust.

Q: We are a short video platform targeting overseas markets and plan to launch paid membership services in Europe and America. However, our mobile payment gateway struggles with adaptation, and commonly used local payment methods cannot be integrated. Additionally, recurring billing rules do not comply with local regulations. How can we build a compliant overseas transaction system?

A: To address the compliance and payment adaptation needs of overseas markets, we will create a dedicated "localized payment + compliant billing" solution, leveraging our experience in cross-border transaction system development to resolve pain points. First, our mobile payment gateway has already established deep integration with mainstream payment channels in Europe and America, such as PayPal and Stripe, while also supporting local payment methods like credit cards and e-wallets to ensure user payment convenience. The recurring billing software will incorporate features such as clear deduction notifications and the ability to cancel subscriptions at any time, in compliance with regional regulations like the EU's GDPR, to avoid compliance risks. Simultaneously, the in-app billing API will ensure adaptation with the overseas version of your app, providing a localized experience for recharge and deduction processes. As a provider of best subscription billing platforms, we will also offer a multilingual version of the refund management system, supporting multi-currency refund calculations in euros, U.S. dollars, etc., in line with local financial norms. The system's built-in transaction risk control module will adapt to overseas anti-fraud rules, ensuring the safety of platform and user funds and supporting your platform's successful expansion into European and American markets.